Laptop depreciation rate calculator

Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value. First we want to calculate the annual.

How Much Is My Laptop Worth How To Price The Old Pc

Depreciation rate finder and calculator You can use this tool to.

. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. Assuming that the useful life for a laptop is three years the depreciation rate stands at 333 but not for the first and final year. SYD depreciation Method Yearly Depreciation Value remaining lifespan SYD x.

If you dont know how to do it take your laptop to any shop near you and theyll do it for a fee of 300400. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing. However the temporary shortcut method is only available for period from 1 March.

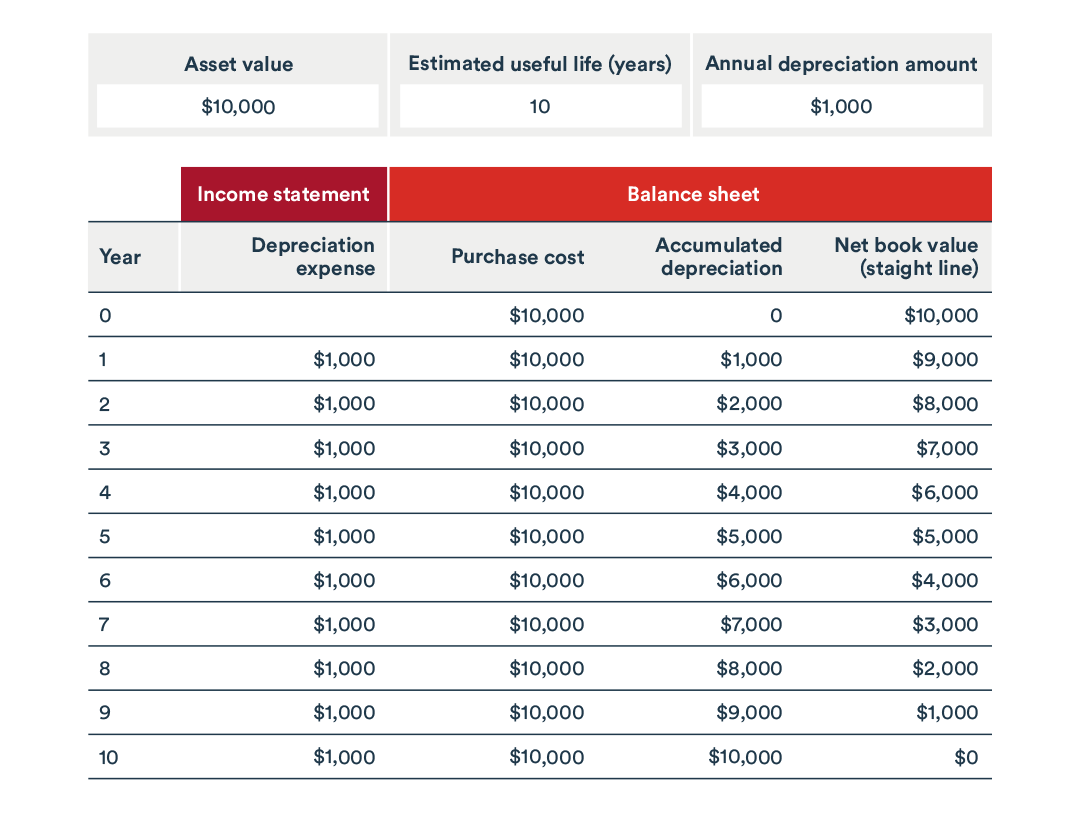

If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. ATO Depreciation Rates 2021.

Open your laptop and clean the fan and the heat sink. éÆGVÆ Ôø å u2½t¹ D _Øi4HÏÏL9QðÅýòäÜšpçÌïKÚPÚ ˆPÚ ³E¼âI_kP VÔ ¼ZfÍžùÝ xÇ DœÜm2 1 Ç xÝV À œTM 6n eTljø³ ÈËdEuÞx7 EìZpÿ Ë. They might ask you to.

Diminishing Value Rate Prime Cost Rate Date of Application. This means there is no need to separately calculate the decline in value of these depreciating assets. Calculating depreciation can get complicated to do by hand which is why its recommended to use a tool that can calculate depreciation for you.

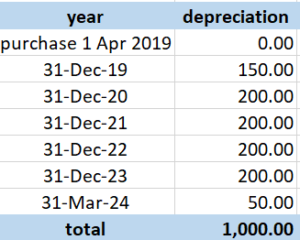

The computer will be depreciated at 33333 per year for 3 years 1000 3 years. There are many variables which can affect an items life expectancy that should be taken into. The formula to calculate depreciation through the double-declining method is.

If the computer has a residual value in 3 years of 200 then depreciation would be calculated. Cost value 10000 DV rate 30 3000. Office Equipment Depreciation Calculator The calculator should be used as a general guide only.

Depreciation Amount Asset Value x Annual Percentage. Not Book Value Scrap value Depreciation rate Where NBV is costs less accumulated depreciation. Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the beginning of the year 3.

Diagnostic measuring and testing assets. Our premium sister site. Then you subtract it from.

If you are trying to calculate how much something has depreciated you need to find out what the current value of an item as a percentage of that items original value.

Top 9 Best Laptops For Engineers In 2021 For Students Or Professionals Blogs Altium

Track Assets And Calculate Depreciation Automatically Youtube

How To Calculate Depreciation Know Your Assets Real Value

How To Book A Fixed Asset Depreciation Journal Entry Floqast

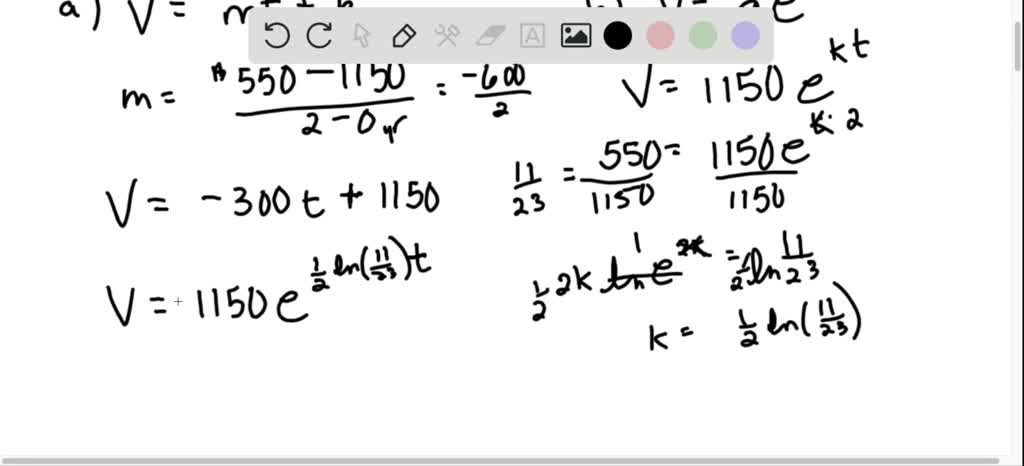

Solved Depreciation A Laptop Computer That Costs 1150 New Has A Book Value Of 550 After 2 Years A Find The Linear Model V M T B B Find The Exponential Model

Calculating Cost Basis In Real Estate Quicken Loans

What Is Amortization Bdc Ca

What Is Depreciation Types Examples How To Calculate Depreciation Jupiter

Top 3 Online Depreciation Calculator To Calculate Depreciation

How To Handle Tangible Fixed Assets Changing Tides

How To Invest In An Ipo Experian

How To Calculate Depreciation Legalzoom

What Is Straight Line Depreciation Yu Online

Ebitda Vs Net Income Infographics Here Are The Top 4 Differences Between Net Income Vs Ebitda Net Income Learn Accounting Income

4 Steps To Choosing The Right Asset Allocation Mix Experian

Sum Of The Years Digits A Depreciation Guide Legalzoom

Surface Laptop Studio Review Redefining What A Windows Laptop Can Be Again Windows Central